Taking a retail business online opens up many opportunities for entrepreneurs and consumers. An online retail platform allows retailers to tap into a global marketplace without the overhead costs of a physical store. Customers from anywhere can access products with the click of a button.

However, a digital storefront has its pitfalls. As our shops go virtual, so do the risks.

The retail sector has seen a significant uptick in cyber threats, with ransomware attacks surging by 75% in 2022, according to Sophos. It’s a clear signal that as much as we love the digital marketplace, we must do more to protect it.

Retail Cyber Insurance protects your clients’ businesses from cyber threats, helping to maintain operational continuity, a seamless shopping experience, and customer trust.

Understanding Cyber Threats in Retail

The retail sector increasingly relies on digital platforms and faces a growing spectrum of cyber threats that jeopardize financial stability and customer trust. Common cyber threats retailers encounter include data breaches and ransomware attacks, which have become more sophisticated over time. According to Verizon’s 2022 Data Breach Investigations Report, 98% of the 629 incidents in the retail sector were financially motivated, often targeting payment and personal data. Hackers breached personal data in one out of every four attacks and stole credentials in almost half of these incidents.

The retail sector increasingly relies on digital platforms and faces a growing spectrum of cyber threats that jeopardize financial stability and customer trust. Common cyber threats retailers encounter include data breaches and ransomware attacks, which have become more sophisticated over time. According to Verizon’s 2022 Data Breach Investigations Report, 98% of the 629 incidents in the retail sector were financially motivated, often targeting payment and personal data. Hackers breached personal data in one out of every four attacks and stole credentials in almost half of these incidents.

Recent statistics highlight the severity of cyber attacks in the retail sector. For instance, the industry’s average data breach in 2022 was $3.28 million, reflecting the immediate financial losses these incidents can inflict. Additionally, a Vercara study underscored the lasting impact on reputation, revealing that 75% of consumers would abandon brands that suffer a data breach.

However, the impact of cyber attacks is perhaps most palpable among major retailers. Many have suffered tremendous losses at the hands ofcyber criminals, compromising millions of customers’ personal data and wiping out millions of dollars in profit. Here are a few high-profile cases in recent history:

- Target’s 2013 attack compromised 41 million payment cards and affected 70 million customers, costing approximately $290 million.

- Through compromised third-party credentials, Home Depot’s breach in 2014 affected 52 million customers, with costs reaching $195 million in pre-tax expenses related to the incident.

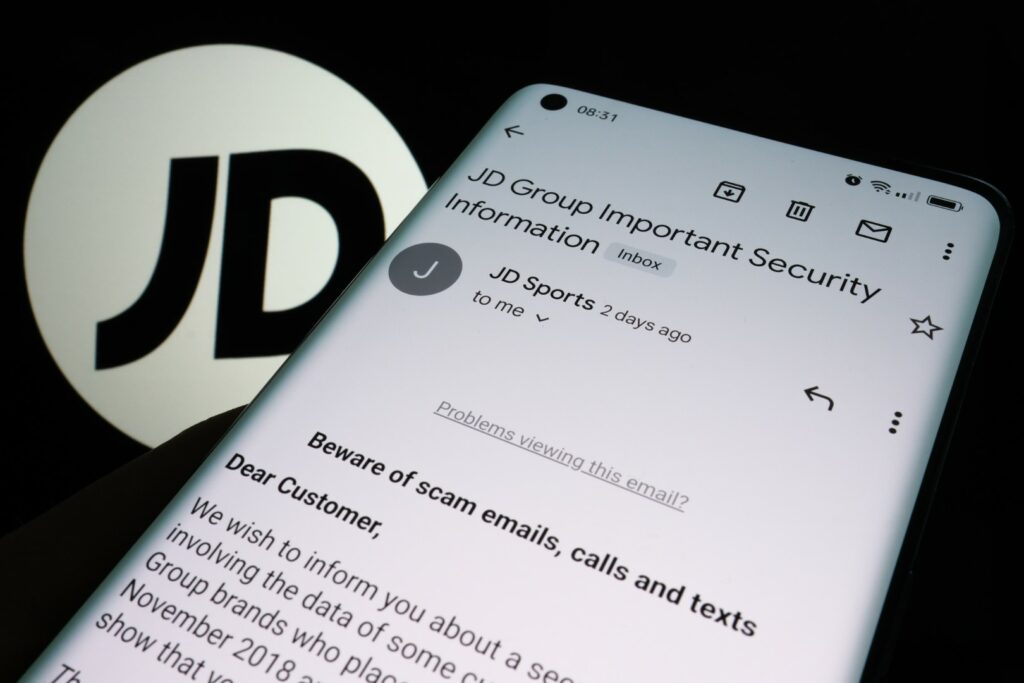

- In 2023, JD Sports suffered a data breach affecting 10 million customers, with undisclosed details of the financial impact.

These incidents underscore the financial and reputational damage cyber attacks can inflict on retailers. Cyber Insurance for retail merchants offers a critical safety net, providing financial protection and support in the wake of cyber incidents. This insurance is not just a cost of doing business in the digital age; it’s a vital component of a comprehensive risk management strategy, ensuring that retailers can recover and thrive after a cyber attack.

Benefits of Cyber Insurance for Retailers

While regular Business Insurance covers the loss of physical assets, Cyber Insurance offers protection from risks associated with digital activities. This coverage is especially important for retail businesses that heavily depend on online transactions and store a lot of customer data.

Retail Cyber Insurance provides comprehensive coverage against a variety of digital threats. Key benefits include:

- Data Breach Response: It covers expenses related to managing a data breach, such as customer notification, credit monitoring services, and legal fees. This benefit is crucial since retailers handle vast amounts of personal and payment information, making them prime targets for data breaches.

- Business Interruption Losses: Retailers can receive compensation for lost income and operational expenses incurred during a shutdown caused by a cyber attack. This benefit ensures that a temporary halt in online sales doesn’t lead to permanent closure.

- Extortion Defense: It includes coverage against ransomware demands, including negotiation services and ransom payments, if deemed necessary. This protection can be invaluable in mitigating the immediate threat to business operations and customer data.

- Legal and Regulatory Costs: It provides protection against lawsuits and regulatory fines from cyber incidents. This aspect of Retail Cyber Insurance is increasingly important as legal requirements around data protection continue to tighten globally.

If your retail clients question whether Cyber Insurance is worth it, emphasize that the rising cyber threats in the industry make it a non-negotiable necessity. The financial and reputational defense it provides positions Cyber Insurance as a vital investment for any retail business in today’s digital marketplace.

ProWriters Offers Comprehensive Cyber Insurance for Retailers

Are your retail clients prepared to withstand a cyber attack? Use your expertise to help them assess their cyber security risks and explore customized Cyber Insurance options for retail merchants with ProWriters Insurance.

Discover how ProWriters can safeguard their business against the ever-evolving digital threats. To find the right policy for your client, sign up for our Cyber IQ Comparative Rate Platform or schedule a call with us to learn more.