Employment-related lawsuits have been on the rise in recent years. Whether brought by individuals or as class-action suits, expenses associated with these claims can quickly escalate and become substantial. If your business clients lack Employment Practices Liability Insurance, you can help protect them by securing a quote for this critical coverage as soon as possible.

EPL Insurance (or EPLI) protects companies from the financial losses that often result from claims made by employees, former employees, or potential employees. It can even cover claims arising from the use of independent contractors.

What does EPL Insurance cover, specifically? Read on for an overview of the kinds of claims EPL Insurance covers, other benefits of carrying an EPL policy, and the best way for you to obtain an Employment Practices Liability Insurance quote for your clients.

Types of EPL Insurance Coverage

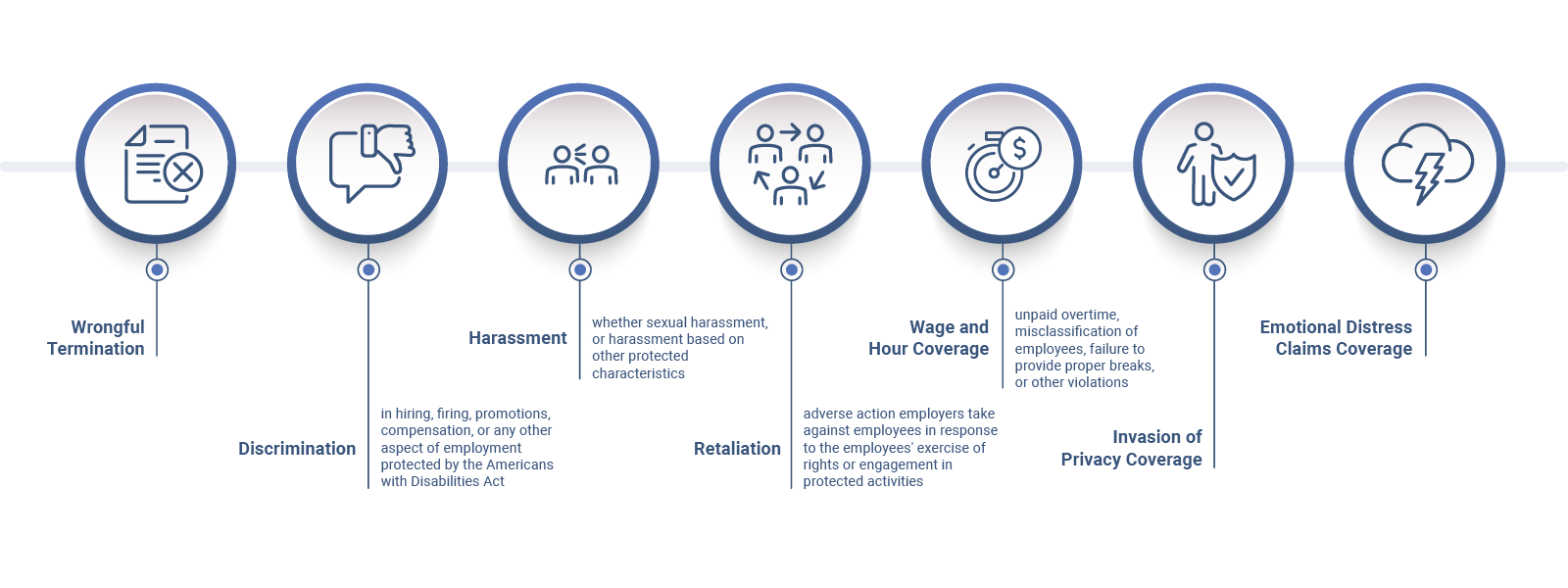

Here are some common types of employment-related claims from which EPL Insurance can help protect businesses and other organizations:

Additionally, third-party EPL Insurance protects employers against such claims when made by non-employees: customers, clients, vendors, and others.

What does EPL Insurance not cover? EPLI doesn’t provide coverage for claims related to workers’ compensation, employee benefit plans, or intentional torts (such as defamation). It doesn’t provide coverage for any damages resulting from a company’s own negligence.

Also, while it covers compensatory damages, which are intended to reimburse an aggrieved employee, EPL Insurance typically doesn’t cover punitive damages awarded against companies for particularly egregious behavior.

Other Benefits EPL Insurance Provides

Insurance companies providing EPL Insurance coverage often offer additional resources to help businesses manage their employment practices’ liability risks. For example, these carriers can provide employee handbooks and guidance on employment policies and procedures to help businesses proactively manage their risk.

Insurance companies providing EPL Insurance coverage often offer additional resources to help businesses manage their employment practices’ liability risks. For example, these carriers can provide employee handbooks and guidance on employment policies and procedures to help businesses proactively manage their risk.

Furthermore, carrying EPL Insurance can demonstrate a business’s commitment to responsible employment practices. This commitment can enhance the business’s reputation in the eyes of employees, prospective employees, and other stakeholders.

How to Best Quote EPLI to Your Business Clients

An Employment Practices Liability Insurance quote allows your client to understand available coverage options, know the associated costs, and ultimately make an informed decision that aligns with their needs.

When determining the cost of EPL Insurance coverage, carriers typically consider a company’s size, industry, claims history, and employment practices, as well as the specific coverage limits desired. The average cost of EPLI coverage varies, but the potential financial risks associated with employment-related claims often make it a worthwhile investment for most businesses.

Comparing quotes from multiple carriers is always best practice. Doing so ensures your client gets the best coverage at the most competitive price. But researching several options and preparing multiple quotes for side-by-side comparison with your clients has usually demanded a lot of your time and effort.

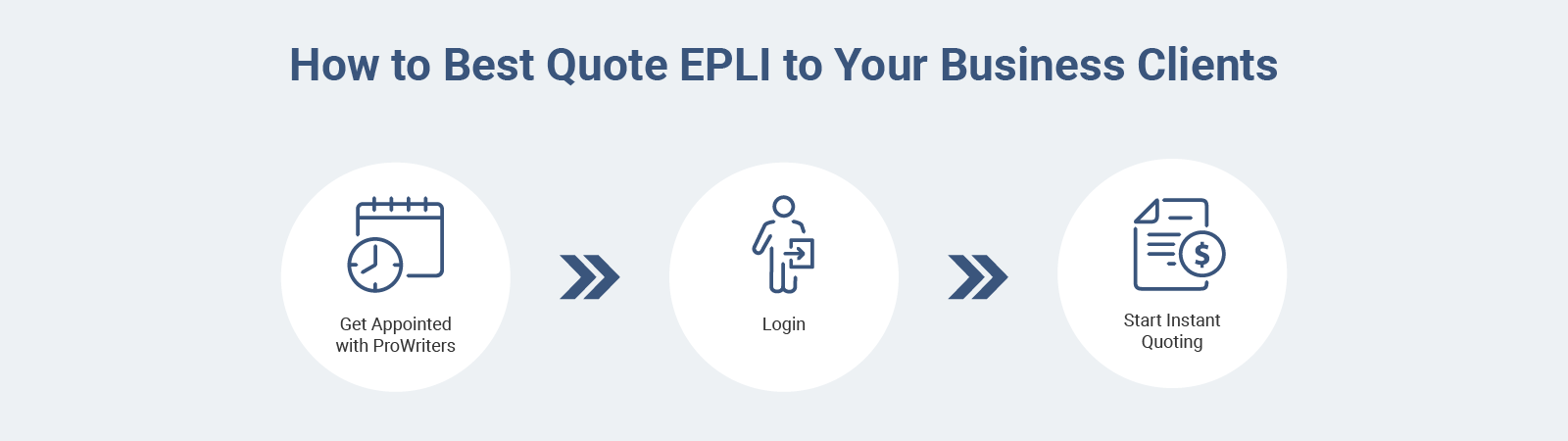

Fortunately, ProWriters is streamlining the process.

Because we’ve added EPL Insurance to our proprietary, powerful Cyber IQ Comparative Rate Platform, you’ll now be able to generate EPLI quotes from industry-leading carriers—including Coalition, Counterpart, Great American, Axis, and ERisk—in mere minutes, just as the platform lets you do for Cyber Insurance quotes.

Employment-related claims can be financially devastating for a business of any size. By using our platform to research, prepare, and compare Employment Practices Liability Insurance quotes for your clients, you’re helping them alleviate these risks and protecting them from potentially costly legal battles.

EPL Insurance offers peace of mind, financial protection, and the means to manage and mitigate employment-related risks effectively.

Register as a ProWriters broker today so you can start securing this valuable coverage for your business clients.