Modern organizations use customer data to enhance their services and deliver customized experiences. While this data-driven approach to doing business offers numerous advantages to consumers, it also raises risks regarding violations of privacy and data breaches. As a result, businesses must adopt stringent cyber security measures and ensure compliance with ever-changing privacy rules.

This guide explores violations of privacy and provides real-world examples, offering brokers insights to help their clients assess their vulnerabilities.

What Is a Violation of Privacy?

The unauthorized disclosure, collection, or handling of an individual’s personal identifiable information (PII) in a manner that violates laws relating to the protection of consumer information is considered a violation of privacy. It can take many forms, from deliberate exploitation of personal information to unintentional errors resulting from inadequate security protocols or negligence.

The unauthorized disclosure, collection, or handling of an individual’s personal identifiable information (PII) in a manner that violates laws relating to the protection of consumer information is considered a violation of privacy. It can take many forms, from deliberate exploitation of personal information to unintentional errors resulting from inadequate security protocols or negligence.

Many people confuse privacy violations with data breaches. However, they are not the same, and as a Cyber Insurance broker, you should know the difference between the two to effectively navigate the associated risks. In a data breach, an external threat actor infiltrates a system or network or bypasses security measures to gain unauthorized access to sensitive data. Meanwhile, a violation of privacy stems from internal practices or the mishandling of data within organizations. Privacy violation examples include unauthorized data sharing with third parties or using customer information for purposes beyond the scope of its intended use.

Why Evolving Privacy Laws and Regulations Matter

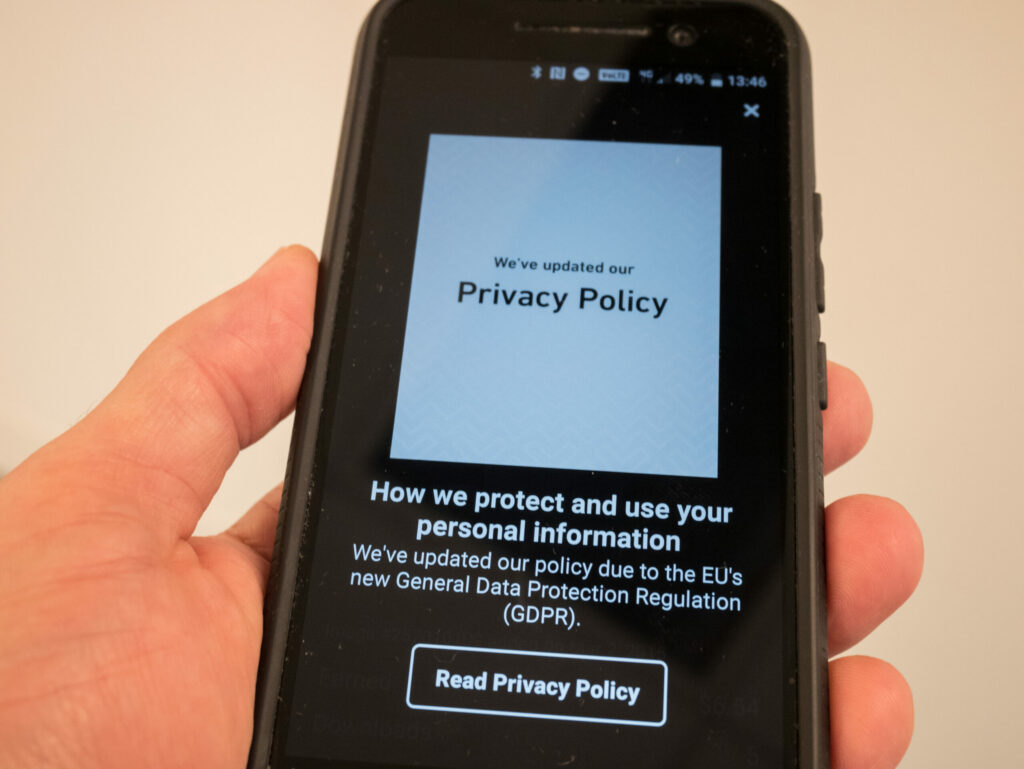

To protect the privacy rights of individuals, government and regulatory bodies have enacted various laws and regulations. A notable example is the General Data Protection Regulation (GDPR), established by the European Union in 2018.

To protect the privacy rights of individuals, government and regulatory bodies have enacted various laws and regulations. A notable example is the General Data Protection Regulation (GDPR), established by the European Union in 2018.

In the United States, the Health Insurance Portability and Accountability Act (HIPAA) and the Privacy Act of 1974 regulate personal data collection, use, and storage in certain industries and contexts. California has been at the forefront of privacy legislation at the state level with the enactment of the California Consumer Privacy Act (CCPA) and the California Privacy Rights Act (CPRA).

Privacy laws will continue to evolve in 2023 and beyond as states such as Virginia, Colorado, Connecticut, and Utah enact their own. Organizations must keep pace with these changes to stay compliant. Brokers play a critical role in guiding their clients through evolving privacy laws and mitigating the risks associated with the violation of privacy acts and data breaches.

Privacy Act Violation Examples

The ramifications of a violation of privacy can be severe for affected parties and stakeholders. The real-world examples below show that it can compromise privacy rights and have legal, reputational, and financial implications for business organizations.

1. Meta Fined Record $1.3 Billion for Overhandling of Users’ Data

1. Meta Fined Record $1.3 Billion for Overhandling of Users’ Data

On May 22, 2023, Meta was fined a record-breaking $1.3 billion by the European Union for violating privacy laws. The fine was imposed due to Meta’s transfer of Facebook users’ data to U.S. servers. The fine set a new record as the highest-ever amount imposed for breaching GDPR, surpassing Amazon’s $888 million fine in 2021.

2. Clearview AI Fined by European Regulator for Data Privacy Regulations and Non-Cooperation

U.S.-based facial recognition technology company Clearview AI was hit with a series of penalties and fines for privacy violations and noncompliance with data protection regulations. In 2021, French regulator CNIL found the company guilty of illegally collecting and processing personal data for building its facial recognition tool, leading to a fine of €20 million.

As the company failed to comply with CNIL’s order, an additional fine of €5.2 million was issued on April 13, 2023. This case highlights the increasing challenge of navigating data protection compliance in the face of rapidly advancing new technologies like AI.

3.FTC Imposes Record $520 Million Fine on Epic Games for Data Privacy Violations and Deceptive Practices

In December 2022, Fortnight creator Epic Games was hit with a massive fine of $520 million by the Federal Trade Commission (FTC) over using deceptive practices that exploit users into paying millions of dollars and violating children’s privacy laws. The company collected personal data from children without obtaining the consent of their parents or guardians. In addition to the imposed fines, Epic Games was required to refund affected users, change their default privacy settings, and undergo compliance audits to ensure adherence to privacy regulations.

Stay Ahead by Partnering with ProWriters

Keeping up with the rapidly evolving data protection landscape and cyber liability can be challenging for Cyber Insurance brokers. To protect your clients from cyber threats and risks associated with violations of privacy, you need to keep pace with industry trends and be a reliable expert your clients can trust. ProWriters can help you achieve this.

At ProWriters, we offer partner brokers free resources and innovative tools to streamline your broker services. Our Cyber IQ Comparative Rate Platform lets you quote leading insurance carriers in minutes. Learn how we can elevate your offerings today by scheduling a call with one of our experts.