The trajectory of average D&O Insurance premiums has been a critical barometer for Cyber Insurance brokers keen on gauging the market’s pulse. After a tumultuous 2021, the horizon seemed promising as brokers witnessed a stabilization of D&O pricing in 2022. However, as we close out 2023, the question remains: Is this stabilization a harbinger of calm or just the eye of the storm?

Understanding the Fluctuations in Average D&O Insurance Premiums

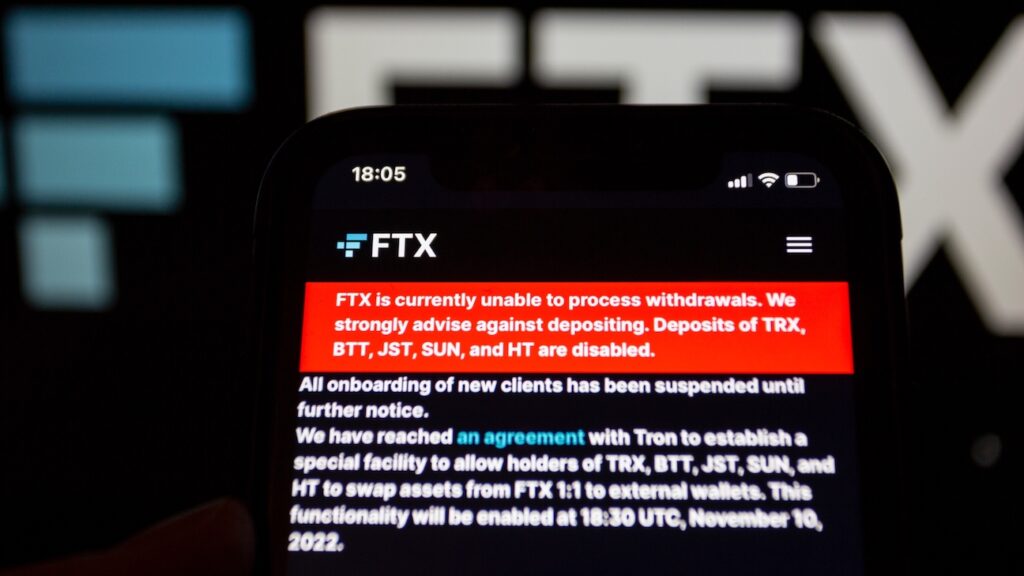

Average D&O Insurance premiums have been subject to several influences, with 2022 playing a pivotal role in the unfolding trends we’re observing this year. Among the key drivers affecting D&O Insurance providers are the high-profile incidents within the finance and crypto sectors. The Credit Suisse Bank collapse and FTX bankruptcy, for instance, sent shockwaves through the industry, reshaping the risk landscape that D&O Insurance providers must now navigate.

Average D&O Insurance premiums have been subject to several influences, with 2022 playing a pivotal role in the unfolding trends we’re observing this year. Among the key drivers affecting D&O Insurance providers are the high-profile incidents within the finance and crypto sectors. The Credit Suisse Bank collapse and FTX bankruptcy, for instance, sent shockwaves through the industry, reshaping the risk landscape that D&O Insurance providers must now navigate.

Moreover, there’s been an uptick in D&O claims, particularly stemming from the surge in employment-related lawsuits as tech giants like Amazon, Google, Meta, and X (formerly Twitter) trimmed their workforce by tens of thousands of employees. Laid-off employees often sue over insufficient layoff notice, inadequate severance, and uncompensated remote work expenses.

This rise in D&O claims is expected to push premiums upward as insurers recalibrate risk assessments.

Anti-ESG Legislation’s Impact on D&O Premiums

Anti-ESG legislation could notably affect average D&O Insurance premiums by barring ESG criteria in risk assessment. Insurers typically consider environmental, social, and governance compliance as indicative of lower risk, but legislative changes could force them to adopt a more conservative stance, possibly leading to higher premiums.

could notably affect average D&O Insurance premiums by barring ESG criteria in risk assessment. Insurers typically consider environmental, social, and governance compliance as indicative of lower risk, but legislative changes could force them to adopt a more conservative stance, possibly leading to higher premiums.

The resultant market uncertainty may drive insurers to adjust rates to offset the risk of increased governance-related litigation. Companies committed to ESG face risks from stakeholder lawsuits over ESG noncompliance and potential premium hikes as insurers grapple with regulatory changes. This could amplify the frequency and severity of D&O claims, thus escalating D&O Insurance costs.

Steady Factors Amidst Dynamic Shifts

While dynamic events have caused ripples, some aspects remain steadfast in determining D&O Insurance costs, including:

- Company Size: Larger firms typically face higher D&O Insurance premiums due to increased exposure to potential litigation and more complex operations.

- Industry Trends: Volatile or high-risk industries like tech or finance might see higher premiums due to a greater likelihood of claims.

- Management Experience: Experienced leadership can lower premiums, as insurers often view seasoned managers as less risky, assuming they’re more adept at navigating legal and financial challenges.

These and other traditional metrics like scope of business, claim history, and operating costs

continue to underpin the foundation of premium calculations.

The State of Private D&O Insurance Pricing

Despite the drama of public markets, private D&O Insurance pricing has experienced a relative calming, partly due to an influx of D&O Insurance providers expanding options and softening the competitive edge. Additionally, a cooling in the IPO market has redirected insurers’ attention.

Yet, this pricing break isn’t consistent across all sectors. High-risk industries, such as cannabis and emergent technologies, continue to encounter elevated premiums. Their distinct risk exposures, such as regulatory uncertainty and rapid market evolution, amplify their susceptibility to D&O claims. Consequently, this compounds and drives up the average D&O Insurance premiums specific to these sectors.

2024 Outlook for D&O Premiums

As 2024 approaches, the D&O Insurance market anticipates continuing from a once-volatile rate environment to more stable conditions. Amidst an economy on shaky ground, top D&O Insurance carriers are competing fiercely, with many underwriters expecting rates to either remain constant or decrease further.

This shift follows a dramatic reversal of the steep rate increases seen from 2019 to early 2021. Woodruff Sawyer’s insights reveal that new market entrants and reduced IPO fervor have led to a surplus in capacity, causing a significant drop in rates. However, with the cyclical nature of the D&O market, companies are advised to secure favorable terms while they last without assuming the soft market will persist indefinitely.

ProWriters Helps Brokers Navigate a Shifting Market

For Cyber Insurance brokers, keeping abreast of the fluctuating average D&O Insurance premiums is essential. You play a critical role as the navigators for companies charting a course through the complex D&O market.

Stay informed and proactive with ProWriters Insurance. Our expertise ensures that your clients are well-prepared for the future and equipped with the right coverage at competitive rates. Embrace the expertise that makes the difference. Find out What Brokers Need to Know About D&O and EPLI, and ensure your clients are ready for whatever comes next.